The Smarter Way to Manage Your Money

IB UNIVERSAL ACCOUNT

The Smarter Way to Manage Your Money

Unlock Your Financial Potential with an All-in-One Solution

Manage all your finances in one account!

Earn Interest

Earn interest up to USD 3.14% on instantly available cash balances1

View Interest DetailsKarta Visa Infinite US Charge Card

A premium US charge card designed for IBKR clients who operate across borders and markets. The card seamlessly links to your IBKR account for monthly payments and gives you instant access to your cash anywhere in the world with no foreign transaction fees.

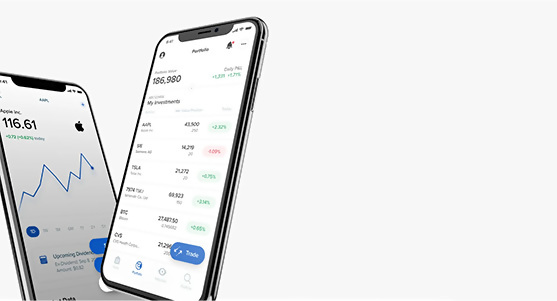

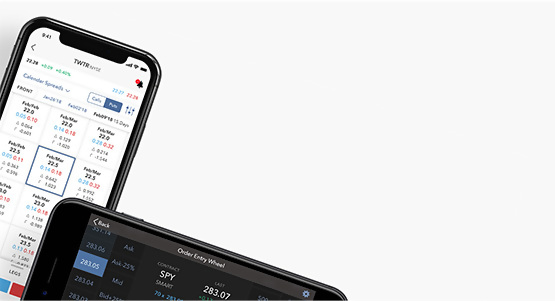

View Card DetailsIBKR Mobile

Check Deposit

Depositing funds to your IBKR account is now as easy as taking a picture with the IBKR Mobile app.

Learn About Mobile DepositsBank Deposit Sweep Program

Our Insured Bank Deposit Sweep Program allows eligible IBKR clients to obtain up to $5,000,000 of FDIC insurance in addition to existing $250,000 SIPC coverage for total coverage of $5,250,000.

Learn About Sweep ProgramDirect Deposit

Automatically deposit funds denominated in USD from your financial institution to your IBKR account.

Learn About Direct DepositStrength & Security

IBKR is a broker you can trust, and our strong financial position and conservative business management protect IBKR and our clients.

Our Strength and SecurityOpen Your Account Today!

Download an app and sign up, or sign up online

Disclosures

- Restrictions apply. For additional information on interest rates, click here. Credit interest rate as of December 12, 2025 .

- For complete information, see ibkr.com/compare.