IBUSOPT Destination and Options Liquidity Tool

PRODUCTS

Achieve Better Price Execution on US Options Trades with the IBUSOPT Destination and Options Liquidity Tool

IBUSOPT Destination

IBUSOPT, an order destination for US equity and index options, is designed to offer clients the opportunity to interact with IBKR SmartRouted™ order flow and have their orders for actively traded options filled between the National Best Bid/Offer (NBBO).

The IBUSOPT destination helps traders execute options trades more efficiently and effectively and helps achieve better executions by providing traders with more control over their trades by supporting different order types.

IBUSOPT orders will wait for an offsetting order from another IBKR client and are not shown to the market.

How it Works:

The IBUSOPT destination provides clients with an opportunity to compete with major liquidity providers for marketable orders prior to the orders being routed to an exchange. Orders on IBUSOPT will wait for an offsetting order from another IBKR client and are not shown to the market. Once there is an offsetting order on IBUSOPT, the orders will be used to start an auction at the exchange. The exchange auction provides price improvement opportunities over the current matched price and lets the orders from IBUSOPT execute against each other or other participants responding to the auction – thereby potentially enhancing execution rates and quality.

To route a US equity or index options order to IBUSOPT from Mosaic, set up the order in the Order Entry panel and open the "advanced" panel to select a new destination. Once you have selected IBUSOPT as the destination, available order types will be shown in the dropdown. To provide liquidity throughout the trading day, use the Options Liquidity Tool.

IBKR Options Liquidity Tool

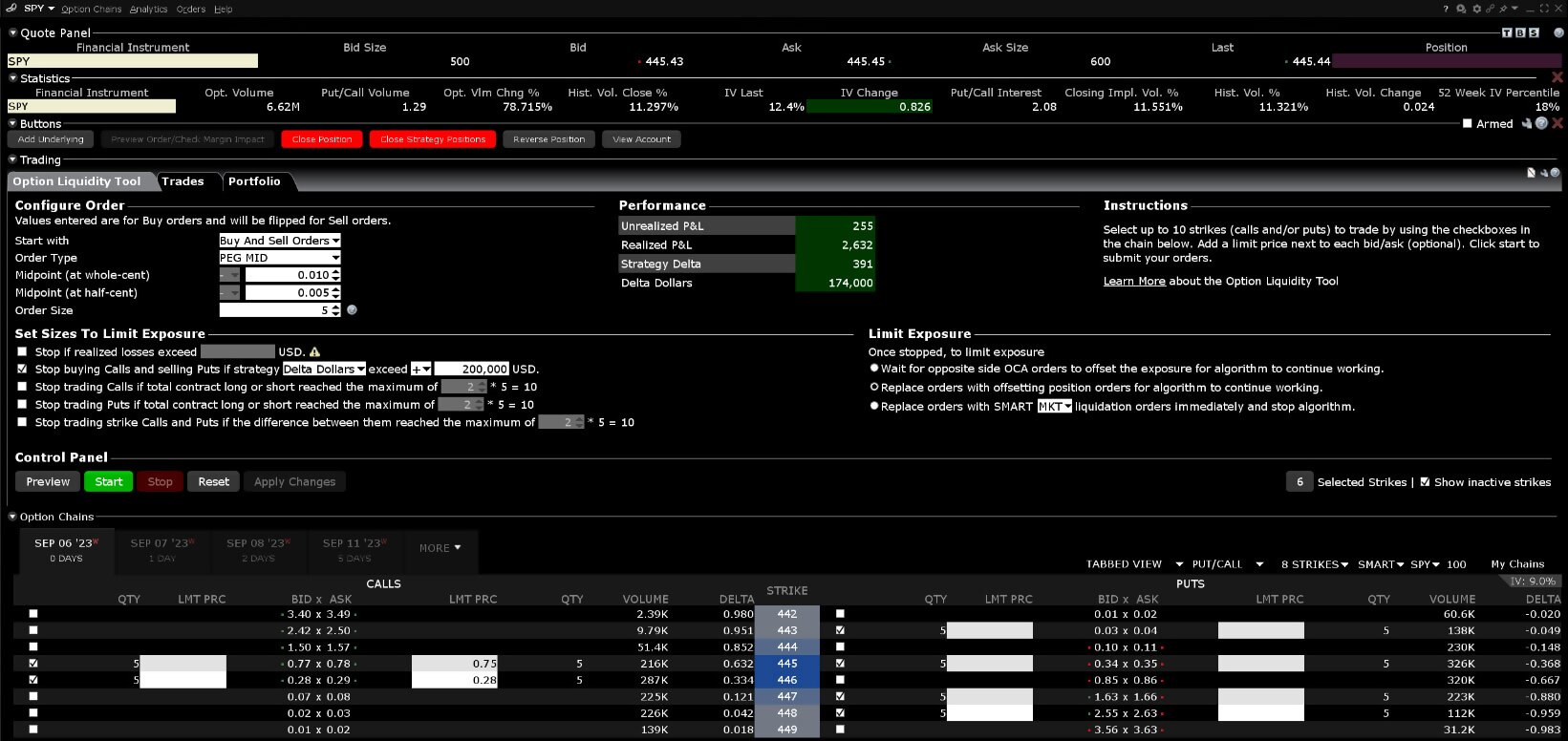

Our Options Liquidity Tool lets options traders create liquidity-adding strategies by directly routing orders to the IBUSOPT destination where it interacts with our order flow.

- A variety of order types are available for posting liquidity in IBUSOPT, including Pegged-to-Midpoint, Pegged-to-Best, and Relative/Pegged-to-Primary.

- Review and update values from presets via corresponding fields for offsets, limit price, quantity and Pegged-to-Best fields.

- Click BUY, SELL, or BUY and SELL to set the number of strikes in both call and put chains.

- Easily preview, start, stop or reset strategies.

- The tool includes a number of risk management features, including stopping a strategy if a negative realized P&L occurs, the strategy delta exceeds a specific value or the strategy delta dollars exceed a specific value.

Each side (i.e., set of strike orders) will be setup as a one-cancels-another (OCA) order attribute in the Trader Workstation (TWS). TWS will attempt to fill one of the orders completely and either cancel the other completely or partially fill multiple orders to equal a final quantity.

TWS tracks strategy performance by creating individual models for each underlying in each account. While a strategy cannot be shared with different users on an account, each user can view the other’s trading strategy. In addition, a Metrics tile provides a real-time summary of P&L and Sensitivity to help you monitor the current strategy.

USER GUIDES

Get Started with the Options Liquidity Tool

For more information on the Options Liquidity Tool, select your trading platform.

Disclosures

- The projections or other information generated by the Option Liquidity Tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.