TWS Release Notes

Volatility Products Tab in IB Risk NavigatorSM

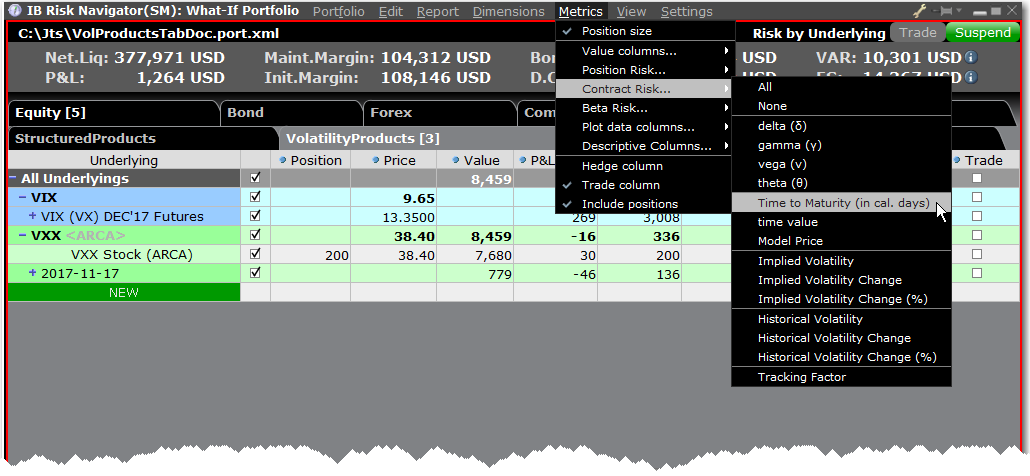

A new tab, Volatility Products, has been added to the IB Risk Navigator. This tab only displays Volatility-based products, including:

- Derivatives based on the widely recognized volatility indexes that are based on an underlying equity or index. These products will also be reflected on the Equity tab, but only the equity Vega contribution, translated from the Delta of the volatility product, will be displayed. (Delta exposure to the volatility index is equivalent to Vega exposure to the underlying, in the proportion: Vega (underlying) = Delta (derivative of Volatility Index) x (Volatility Index-specific scaling factor).

- Funds including ETFs/ETNs composed of portfolios of instruments providing exposure to some volatility indexes. Again, the Delta of the volatility product will be transformed to Vega for display on the Equity tab. Assuming the fund has constant sensitivity to some volatility index, its Delta can be translated to the Vega of the underlying as follows: Vega (underlying) = Delta (to fund price) x (Sensitivity of fund price to Volatility Index) x (Volatility Index-specific scaling factor).

The price sensitivity of ETF/ETN funds to volatility indexes has been shown to be approximately stable using our default beta calculation methods, but some users may want to express a view that is different from what the historical data would suggest. To do this, right-click the contract in the report and select Tracker/Measure Beta..., then enter the user defined value that you want to override the historical estimate.

To display this tab, open Risk Navigator from the New Window drop down list, and from the View menu select Volatility Products tab. You will be asked to close and re-open Risk Navigator for this change to take effect.

To find out more about the Volatility Products tab and its data, see the TWS Users' Guide.

In addition to the new Volatility Product tabs, Risk Navigator has several other enhancements:

- We have added the column "Time to Maturity (in cal days)" for reports. To add this column to a report, from the Metrics menu select Contract Risk and then select "Time to Maturity (in cal days)".

- We now show you the number of open (category-related) positions in the product tab next to the title.

IBot Learns your Phrasing Style

We continue to make IBot smarter. In cases where there is more than one interpretation of your inquiry, IBot will ask you to pick among several options. Your selection will be remembered, and will be used to improve IBot's comprehension.

Editable Order Quantity Fields

You can view and edit order quantity in two fields. The "Total Quantity" field which always displays the orders's original size, and the "Quantity" field, which updates as the order fills to reflect the shares remaining to fill. The Quantity field is also labeled "Outstanding Quantity." In addition to these editable fields, the read-only "Filled Quantity" field reflects the number of shares that have filled (Quantity + Filled Quantity = Total Quantity).

By default, you are able to edit the"(Outstanding) Quantity" field. To also enable editing of values in the "Total Quantity" field, in Global Configuration go to Orders and then Settings. and check "Allow editing Total Quantity." You may deselect "Allow editing Outstanding Quantity" if desired, but you cannot disable both quantity editing fields.