TWS Version 949 - Release Notes

Continuous Futures Data

You can now select a "continuous" futures contract when adding a contract to your Watchlist or trading page.

To choose a continuous contract, select the contract with the infinity sign. Additionally, you can view the rollover points between expiring lead futures in your chart by enabling Show futures rollover points in the Charts>Settings page in Global Configuration. Note that these continuous contracts are for market data only; orders on futures are not updated. If you select a non-continuous contract, the Automatic Futures Rollover feature (if enabled) will notify you that the contract is expiring.

New Fundamental Research Amenities

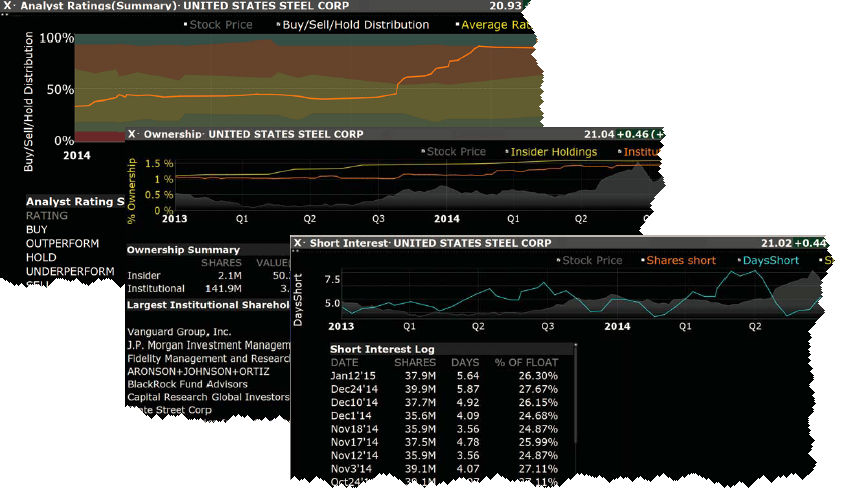

We have added three new tear sheets, described below, to our suite of Fundamentals research tools. Note that all chart overlays include labeled checkboxes that allow you to include/exclude by checking or unchecking the box.

- Analyst (Summary) - In a world where upgrades and downgrades move markets, staying on top of analyst activity is a necessity. Our new sell-side Analyst Rating tear sheet provides summary rating and price target statistics along with upgrade/downgrade history, and graphs mean ratings history, price target history and rating distribution over time. Full display requires subscription to Reuters Fundamentals.

- Ownership - Get detailed insider and institutional ownership statistics and graphs for free to incorporate into your investment strategies. The Insider and Institutional Ownership tear sheet provides detailed institutional and insider ownership rosters with a graph of ownership percentage over time, and an insider trade log.

- Short Interest - Keep an eye on short interest profiles with our new Short Interest tear sheet. Graphs short interest as a percent of float, days short, or shares short, while the short interest log provides exact values on a semi-weekly basis.

To access these new Fundamentals tools, from the New Window dropdown select Fundamentals, and then choose Analyst (Summary), Ownership, or Short Interest.

Enhanced Performance for Option Rollover

The sidecar selector for the Option Rollover tool has been streamlined resulting in enhanced performance.

Trade Bonds in Mosaic Order Entry Panel

The Mosaic Order Entry panel now supports trading bonds. The context-sensitive panel content is modified for bond orders. The Order Presets button is included for quick default changes. The Last and Yield fields are displayed, and the Quantity value displays in bond sizes. Click the Bid, Ask or Last price to update the price field. Note also that the Order Types list includes only order types available for bonds, and the Advanced panel includes only those items applicable to bond orders. This support is available in TWS versions 948 and higher.

More IB Chart Indicators

As promised we continue to add new indicators to our interactive charts. The most recent additions are always added to the top of the list.

- Relative Vigor Index - The Relative Vigor Index measures the conviction of a recent price action and the likelihood that it will continue by comparing the positioning of a security's closing price relative to its price range. The result is smoothed by calculating an exponential moving average of the values. It's similar to the stochastic oscillator, but the vigor index compares the close relative to the open rather than relative to the low. The value will likely grow as the bullish trend gains momentum as a security's closing price tends to be at the top of the range while the open is near the low of the day.

- Vertical Horizontal Filter (VHF) - The Vertical Horizontal Filter determines whether prices are in a trending phase or in a trading range, aka a congestion phase. This determination may be one of the most difficult dilemmas in technical analysis. Trend-following indicators such as the MACD and moving averages are excellent in trending markets, but may generate multiple conflicting trades during trading range or congestion periods, while oscillators such as the RSI and Stochastics work well when prices fluctuate within a trading range, but they almost always recommend closing positions prematurely during trending markets. The VHF indicator attempts to determine the "trendiness" of prices to help a trader decide which of these indicator types to use.

- Connors RSI - A three period RSI, the Connors RSI is a composite indicator consisting of three components. Two use the Relative Strength Index (RSI) calculations developed by Welles Wilder in the 1970's, and the third ranks the most recent price change on a scale of 0 to 100. Working together, these three factors form a momentum oscillator, i.e. an indicator that fluctuates between 0 and 100 to indicate the level to which a security is overbought (high values) or oversold (low values).

- Coppock Curve - The Coppock curve is a long-term price momentum indicator used primarily to recognize major bottoms in the stock market. It is considered to be an excellent tool for discriminating between bear market rallies and true bottoms in the stock market. The indicator was designed for use on a monthly time scale and is calculated as a 10-month weighted moving average of the sum of the 14-month rate of change and the 11-month rate of change for the index. A buy signal is generated when the indicator falls below zero and turns upward from a trough. Because the Coppock curve is a trend-following indicator, it does not pick an exact market bottom, but may identify rallies and reveal when a new bull market has begun.

- Klinger Oscillator - Used to determine long-term trends of money flow while remaining sensitive enough to short-term fluctuations to predict short-term reversals. This indicator compares the volume flowing in and out of a security to price movement, and it is then turned into an oscillator. A signal line (13-period moving average) is used to trigger transaction decisions. This technique is very similar to signals that are created with other indicators such as the MACD (moving average convergence divergence). The Klinger Oscillator also uses divergence to identify when price and volume are not confirming the direction of the move. It is considered to be a bullish sign when the value of the indicator is heading upward while the price of the security continues to fall. It is recommended to use other tools such as trendlines, moving averages and other indicators to confirm the reversal.

- McGinley Dynamic - The McGinley Dynamic is a smoothing mechanism for prices that often tracks far better than any moving average. It minimizes price separation and price whipsaws and hugs prices much more closely. Because of the calculation, the Dynamic Line speeds up in down markets as it follows prices yet moves more slowly in up markets.

- Vortex - A two-line oscillator comprising an uptrend line (VI+) and a downtrend line (VI-). Used to spot trend reversals and confirm current trends. An uptrend or buy signal occurs when VI+ crosses above VI-. A downtrend or sell signal occurs when VI- crosses above VI+.

- Volume Weighted Moving Average - Identical to our existing Weighted Moving Average indicator except that it uses volume data instead of price data.

- Volume Exponential Moving Average - Identical to our existing Exponential Moving Average indicator except that it uses volume data instead of price data.

- True Strength Index (TSI) - The TSI is designed to show trend direction and

overbought/oversold conditions, and uses moving averages of the underlying momentum of a financial

instrument. Momentum is considered a leading indicator of price movement, and a moving average characteristically lags behind price. The TSI combines these

two characteristics to create an indication of price and direction more in sync with

market turns than either just momentum or just the moving average. - MA Crossover - A crossover occurs when a faster Moving Average (i.e. a shorter period moving average) crosses either above or below a slower (i.e. longer period) moving average. A crossover that moves above a slower MA is considered a bullish crossover; one that moves below is considered a bearish crossover.

- Arnaud Legoux Moving Average - Arnaud Legoux Moving Average (ALMA) removes small price fluctuations and enhances the trend by applying a moving average twice, once from left to right and once from right to left. At the end of this process the phase shift (price lag) commonly associated with moving averages is significantly reduced. Zero-phase digital filtering reduces noise in the signal. Conventional filtering reduces noise in the signal, but adds a delay.

- Variable Moving Average - An exponential moving average that adjusts its smoothing constant on the basis or market volatility. Its sensitivity grows as long as the volatility of the data increases. The performance of this exponential moving average is improved by using a Volatility Index (VI) to adjust the smoothing period as market conditions change.

- Performance - The Performance indicator displays a security's price performance as a percentage. This is sometimes called a "normalized" chart. The Performance indicator displays the percentage that the security has increased since the first period displayed. For example, if the Performance indicator is 10, it means that the security's price has increased 10% since the first period displayed on the left side of the chart. Similarly, a value of -10% means that the security's price has fallen by 10% since the first period displayed. Performance charts are helpful for comparing the price movements of different securities.

- Pivot Points High/Low - Pivot points are used to project potential support and resistance levels. Main time periods are daily, weekly and monthly.

- Weighted Close - Presents an average of each day's price with extra weight given to the closing price.

- Bill Williams Alligator - The Alligator indicator comprises three lines each of which represents a moving average. The blue line represents the jaw, the red line represents the teeth, and the green line the lips. All of the moving average lines are editable and use the exponential moving average as the default. The interaction between the three lines helps identify trends.

- Bill Williams Alligator Oscillator - This indicator is displayed as a line chart in a plot separate from the Alligator. The Alligator Oscillator includes the same configurable fields as the Alligator plus a field to adjust the plot height of the indicator.

- Chop Zone - Visual indicator designed to identify trends and choppiness. Plotted within -100/+100 levels, the Chop Zone illustrates the difference between close price and its EMA by converting its values to colors.

- Choppiness Index - Designed to determine whether the market is choppy or trading sideways, or not choppy and trading within a trend in either direction. On the scale from 1 - 100, the market is considered to be choppy as values near 100 (over 61.80) and trending when values are lower than 38.20).

- Zigzag - A series of trendlines that connect the tops and bottoms of significant prices. Connection criteria is defined using the indicator's Minimum Change or Percent Change parameter.

Fixes and Changes

The following have been fixed or modified in TWS version 949:

- Mosaic Watchlist tabs disappeared when user first logs in to TWS version 948. This has been fixed.

- In the Option Exercise tool, the "Early Exercise" indicator icon was displaying too early due to an error calculating the day.